Printable Self Employed Tax Deductions Worksheet

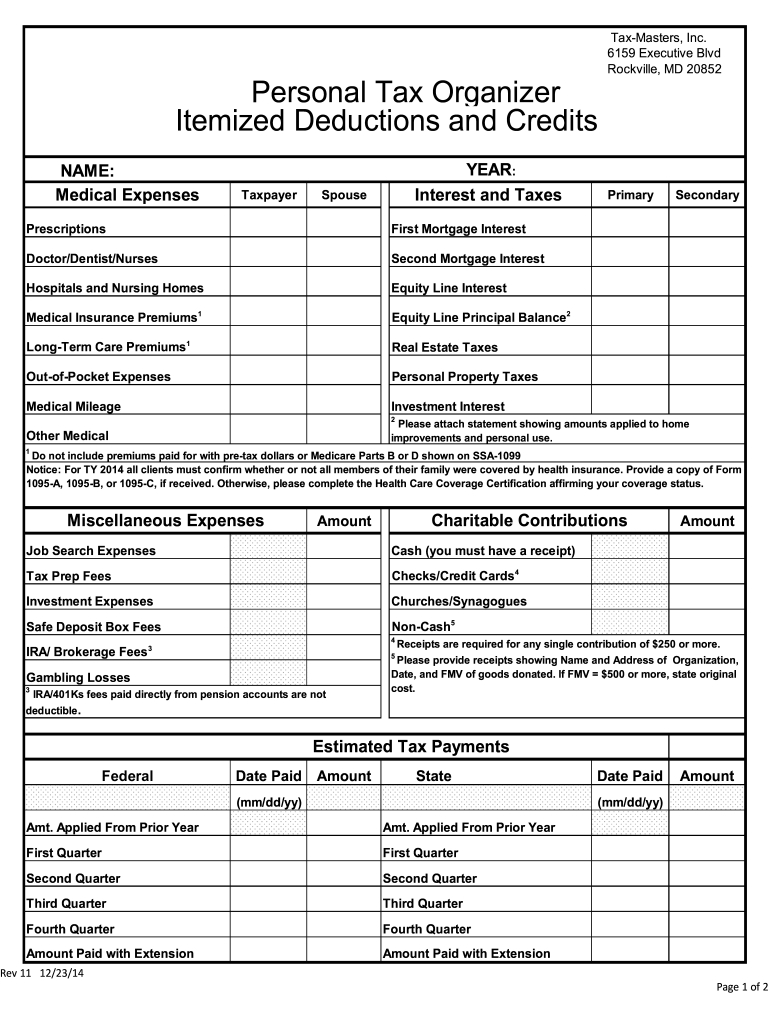

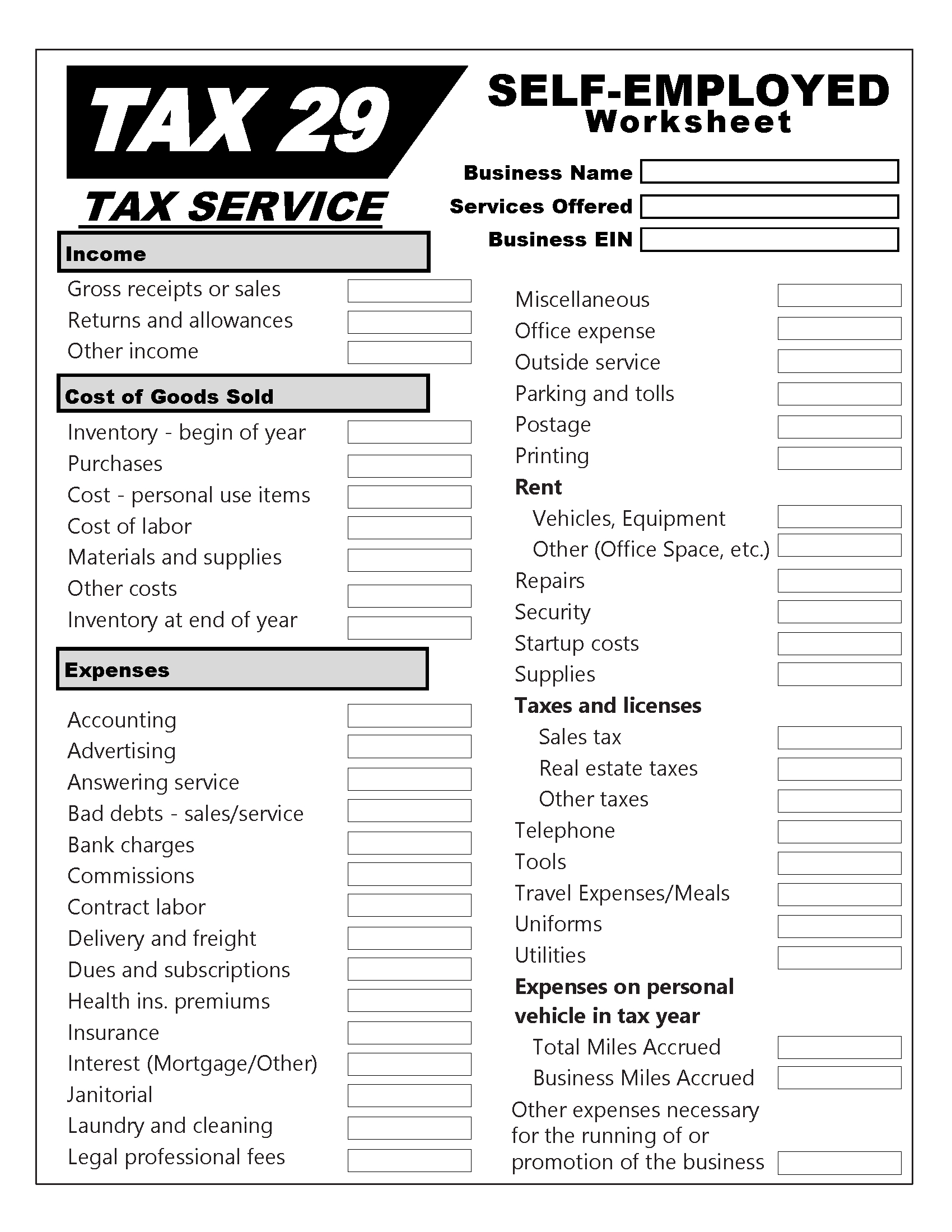

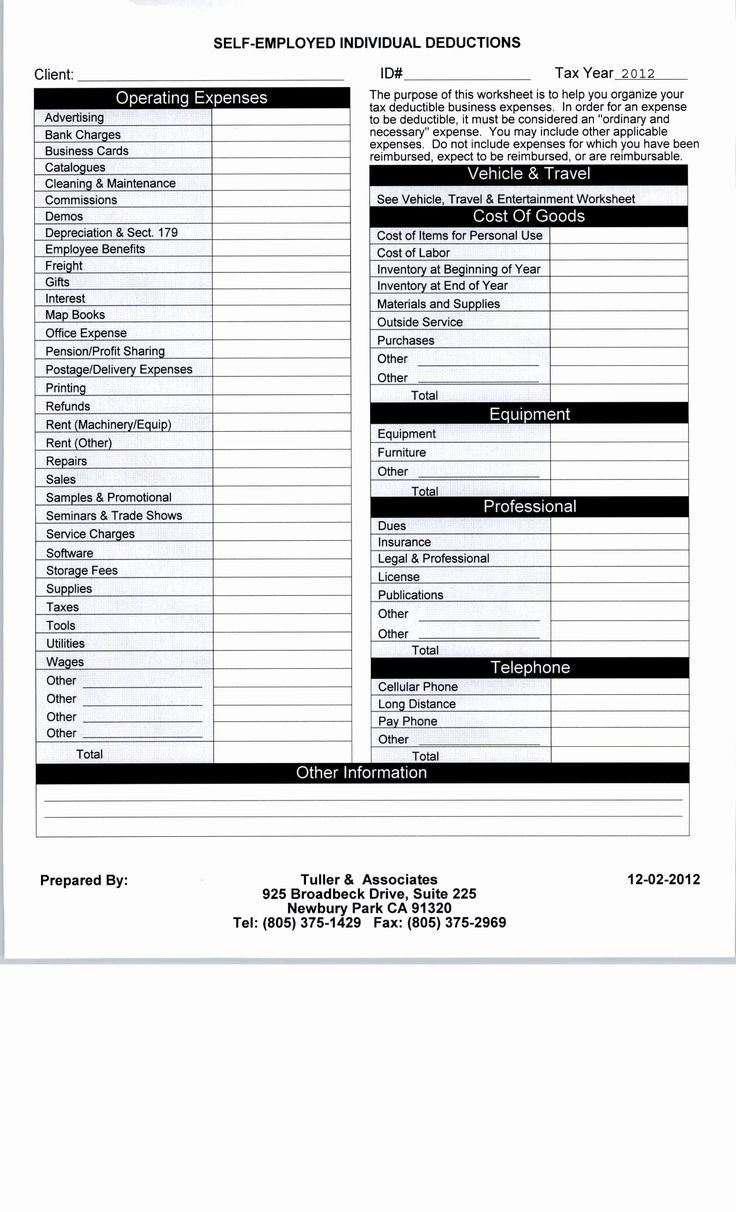

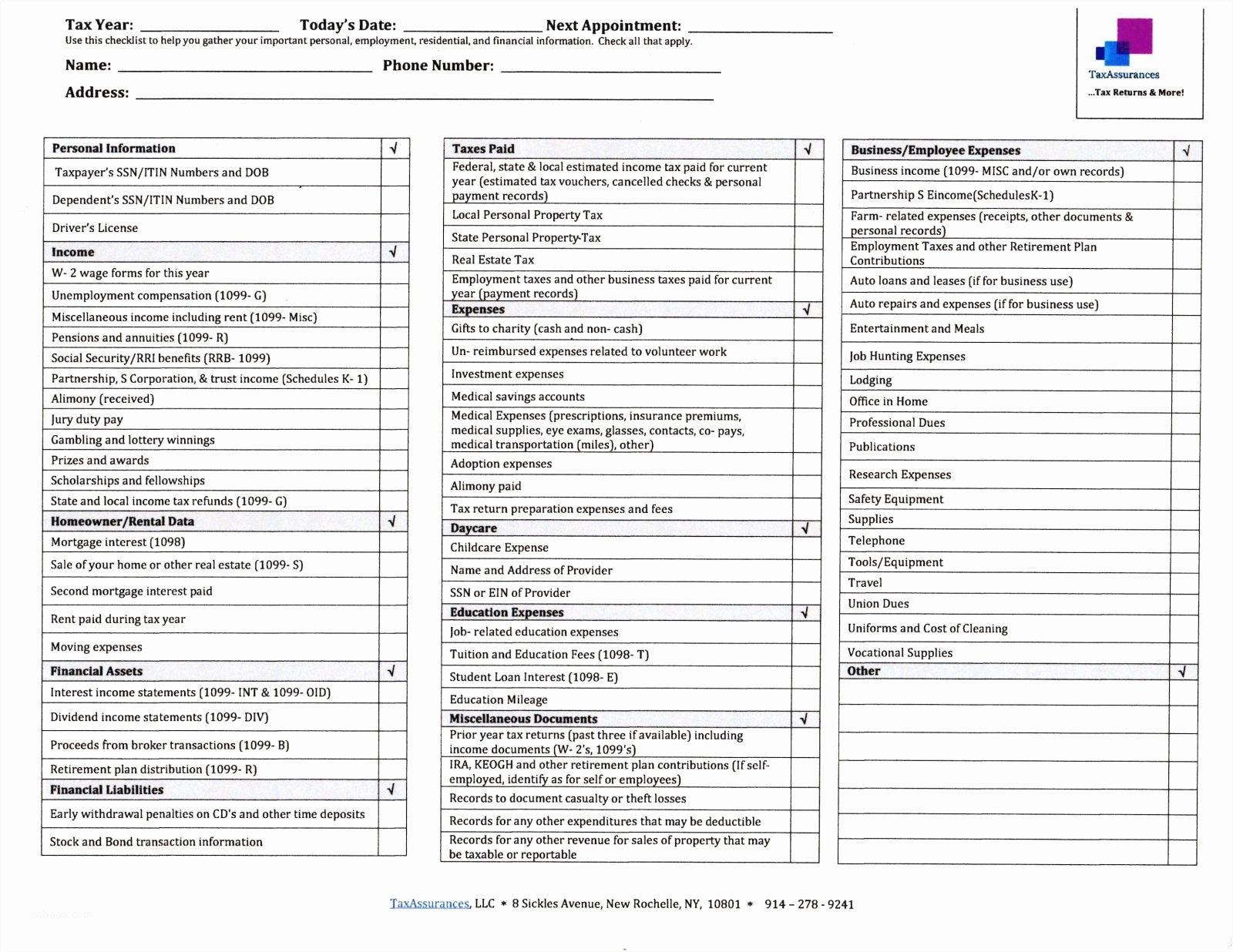

Are you a self-employed individual looking to optimize your tax deductions? Look no further than a printable self-employed tax deductions worksheet to help you keep track of your expenses and maximize your savings. This handy tool allows you to easily organize your deductions, making tax season a breeze. With the right deductions, you can save money and minimize your tax liability, giving you more funds to invest back into your business or enjoy in your personal life.

Maximize Your Savings

One of the key benefits of using a self-employed tax deductions worksheet is the ability to maximize your savings. By keeping track of all your expenses throughout the year, you can ensure that you are not missing out on any potential deductions. From office supplies to travel expenses, every cost incurred in running your business can potentially be deducted from your taxable income. With the help of a worksheet, you can easily categorize and calculate your deductions, ensuring that you are taking full advantage of all available tax breaks.

Moreover, a printable worksheet can serve as a valuable reference tool when preparing your tax return. Instead of scrambling to gather receipts and invoices at the last minute, you can simply refer to your worksheet to ensure that you have accounted for all deductible expenses. This can help streamline the tax filing process and reduce the risk of errors or oversights, ultimately saving you time and stress during tax season.

Stay Organized and Stress-Free

Staying organized is key to successfully managing your self-employment finances, and a tax deductions worksheet can help you do just that. By documenting your expenses in a systematic manner, you can track your spending patterns, identify areas for potential savings, and make informed decisions about your business budget. This level of organization not only benefits you during tax season but also throughout the year as you manage your finances and plan for the future.

Additionally, a printable worksheet can provide peace of mind by ensuring that you are in compliance with tax laws and regulations. By keeping accurate records of your deductions, you can confidently defend your tax return in the event of an audit. This level of preparation can alleviate stress and uncertainty, allowing you to focus on growing your business and achieving your financial goals. With a self-employed tax deductions worksheet, you can take control of your finances and set yourself up for success as a self-employed individual.

More FREE Printables…

Copyright Notice: The images on this site are owned by their respective creators. Please contact us for credit or removal requests.